The short version

Why it matters: Every quarter we release our State of Trade Survey and it is the longest survey of its kind to track the experience of small to medium-sized (SME) construction firms in the UK. The research is a vital tool to help us understand what is happening in the industry. We present this data to Government through the meetings we have with MPs and written policy submissions, such as our recent submission to the Labour Policy Forum and the upcoming Conservative Policy Forum. The data from the State of Trade survey, alongside our policy groups is a fundamental way to influence Government decision making.

What we found: In our latest survey (Jan-Mar '23), we asked our members a series of questions which helped us to identify how the industry is being affected by political changes and economic challenges such as the cost of living and energy crisis.

- There is an overall recovery in enquiry and workload levels for the RMI sector on the previous quarter.

- Almost nine in ten (87%) of FMB members report an increase in material costs.

- At least one in three FMB members reported that they are struggling to recruit carpenters/joiners, bricklayers and general labourers are (41%, 36%, and 31%)

- 1 in 10 (10%) of FMB members reported that their business is experiencing difficulties and could be at risk of closure.

The detail

Does the future lie in more energy efficient builds?

The data from the Q1 2023 State of Trade Survey introduces us to new data, which helps us understand what our members are working on in each sector, as well as the impact a consistent rise in inflation is having on local builders.

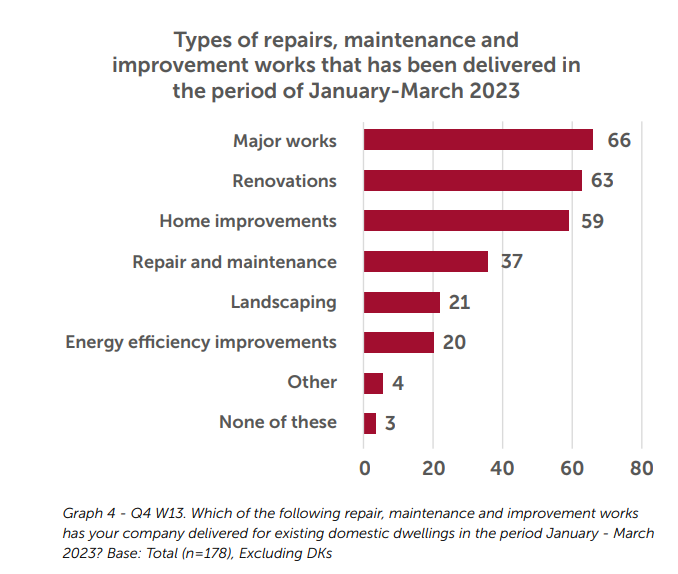

This new data specifically helps us identify what type of work members in the repair, maintenance and improvement (RMI) sector are doing and we found that major works (66%) and renovations (63%) are the most common RMI works for our builders, while 59% of members are working on home improvements. The data also shows us that 20% of our RMI members are working on energy efficiency projects, which is likely to increase in future surveys given that this will be a large part of future work for the industry. The graph below gives a breakdown of all the types of work our members have carried out this quarter.

House building struggles

Workloads in the house building sector have marginally improved since the previous quarter. However, the sector is continuing to struggle. Enquiry levels this quarter have improved only slightly. It’s troubling that house building is the weakest-performing area within construction as the country is in the grips of a housing crisis, with smaller builders feeling the pinch on top of decline in their output over recent decades.

The FMB supports the Government’s plans to build more beautiful and locally sympathetic homes, but there is no clear plan for how this will happen. We need to see increased funding to local authority planning departments to help them take on and train more planning staff and a greatly simplified planning process to get homes out of planning purgatory”.

Builders are raising prices and tightening their belts

This quarter our data reveals how many of our members have felt the effects of inflation, the rise in the cost of living and energy prices, as well as a spike in material costs. Just under half of members who had stated that their costs were up have said that their bottom lines are being squeezed and are falling below their expected margins as a result. One in five members with rising costs say this will impact whether they can take on new staff and three quarters (75%) of FMB members reported an increase in the prices they charge for work, while 45% of members reported that business profits were lower than expected this quarter.

Further information

You can find a full breakdown of our recent findings in our Q1 2023 State of Trade Survey.